The coronavirus payment tracker makes it easy to check on your payment status.

As the economy continues to struggle, the United States government has committed to making the financial strain a little easier on us by sending most Americans a Coronavirus stimulus check. The first wave of payments has hit bank accounts across the country, but if you didn't get yours, you're probably wondering about the status.

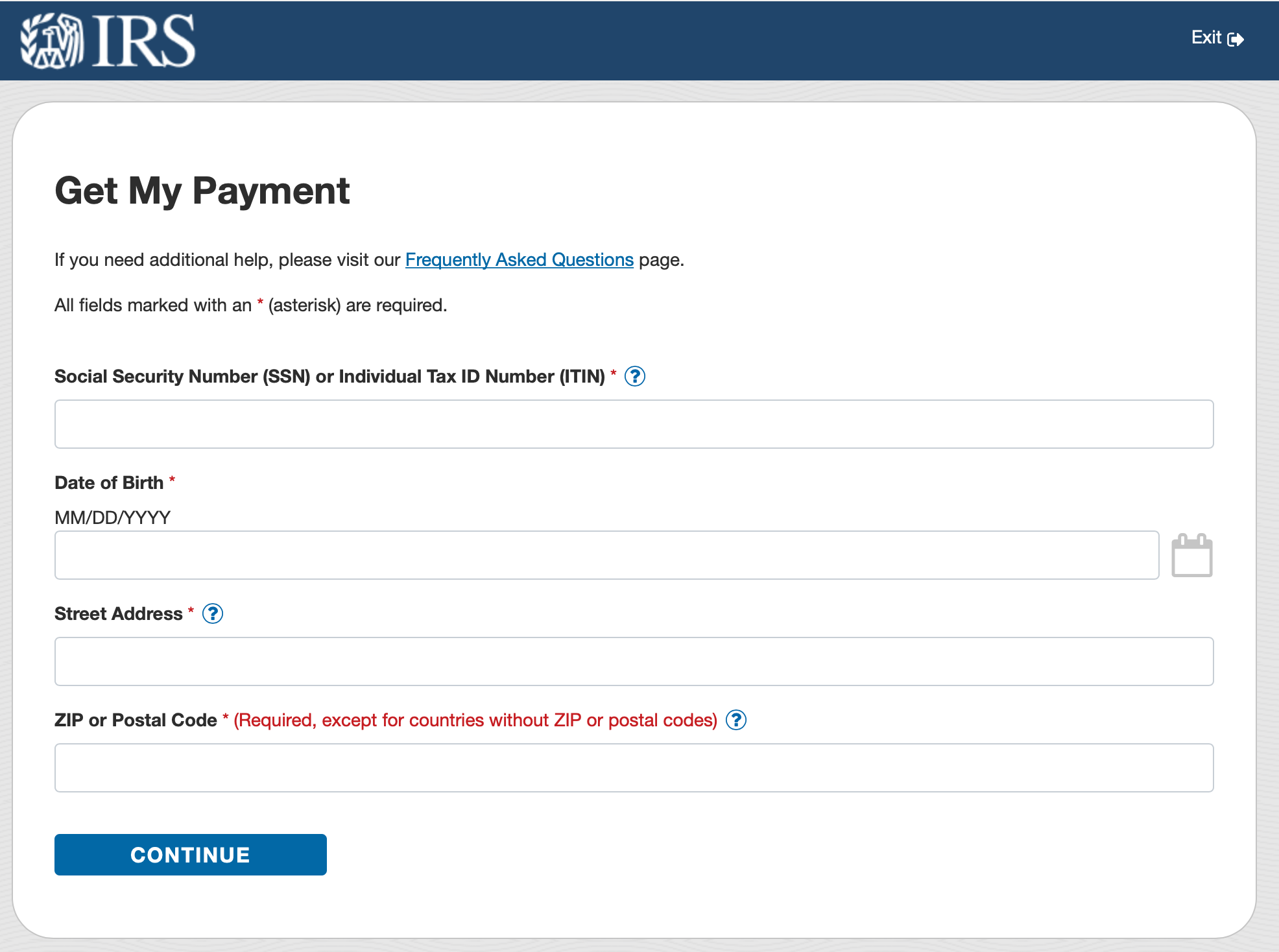

The IRS has created a coronavirus payment tracker that is easy to use and will get you the answers you need in a matter of a minute or two.

If you Filed Taxes

If you filed taxes for 2018 or 2019, head to the IRS website and click 'Get my Payment.' You'll be asked to enter information about yourself including your:

- Social Security number

- Date of birth

- Street address

- Zipcode

You'll then be provided with information regarding your payment status and payment method, whether a direct deposit or a mailed check. If the IRS doesn't have your direct deposit information, you can enter the information if they haven't sent your payment yet.

If You Didn't File Taxes

If you didn't file taxes in 2018 or 2019, you'd click on 'Non-Filers.' If you receive Social Security benefits or Railroad Retirement Benefits, you don't have to take this step even if you didn't file taxes. The IRS has your information.

You'll need to create an account and file a 'minimum return' to receive your payment. You'll need to provide the following information:

- Full name and address

- Social security and date of birth

- Bank information

- Driver's license number

- Identifying information for any children (if applicable)

Who is Eligible?

All U.S. citizens that cannot be claimed as a dependent on someone else's return and have a valid Social Security number are eligible as long as they make less than the following amounts:

- Single filers - $75,000

- Head of household filers - $112,500

- Married filing joint filers - $150,000

If you do make more than above, you may be eligible for a reduced benefit if you fall within the following ranges:

- Single filers - $75,000 - $99,000

- Head of household filers - $112,500 - $136,500

- Married filing joint filers - $150,000 - $198,000

If your income is higher than the above amounts, you may not be eligible for a stimulus check.

The IRS updates their coronavirus payment tracker once per day, so you don't have to check it frequently. If your information isn't in the system yet, check back daily.

As the stimulus checks make their way through the country, make sure that you are aware of potential scammers and fraudulent checks. Never give your information out to anyone that claims they are from the IRS - they aren't going to call you about the check. The only communication you should hear from the IRS is a letter stating that they mailed your check a week or two after they mail it to make sure you received it.