Home > Taxes

Taxes

What to Do With Your Tax Refund: 5 Smart Ideas

Tax refunds can bring a windfall of extra income that might trigger the urge to splurge.

How to Get a Property Tax Reduction

Most homeowners must pay property taxes but knowing how to get a property tax reduction can reduce your cost. Here’s what you must know to lower your taxes.

Everything You Need to Know About the 2021 US Stimulus Differences

Wondering about the 2021 stimulus differences and how they’ll affect you and your household? Learn what you’ll receive and when.

Recent Articles

Understanding the Home Office Tax Deduction

If you’ve been working from home for all or most of 2020, you might be able to lower your tax bill using the home office deduction.

Should You Move to a State with No Income Tax?

Income taxes may make you want to move to a state with no income tax. But should you?

How Your Unemployment Benefits Are Taxed

Believe it or not, your unemployment income is considered taxable income.

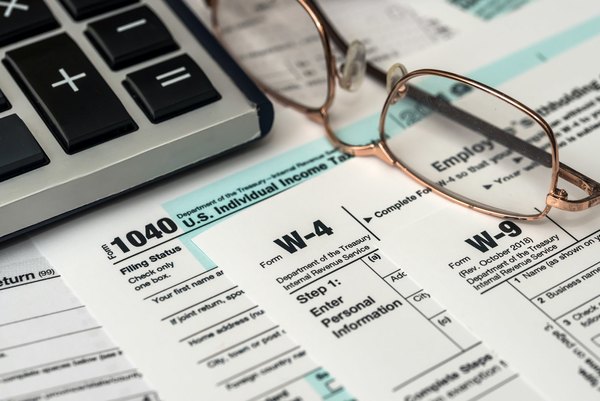

The Right Way to Complete Your W-4 Form

Predicting how much tax you'll owe can seem overwhelming, but if you understand the form better, you can accurately complete it.

Should I Prepare my Own Taxes or Hire an Accountant?

Should I Prepare my Own Taxes or Hire an Accountant?

February 5, 2020

Things To Know When Filing Taxes as an Independent Contractor

Things To Know When Filing Taxes as an Independent Contractor

February 3, 2020

Taking Tax Deductions When You Work From Home

Taking Tax Deductions When You Work From Home

January 19, 2020

3 Top Tax Services to File Your Own Taxes in 2020

3 Top Tax Services to File Your Own Taxes in 2020

January 12, 2020

You Might Have To Pay Income Tax On Your Social Security Income

You Might Have To Pay Income Tax On Your Social Security Income

January 6, 2020